1. Choose the right location

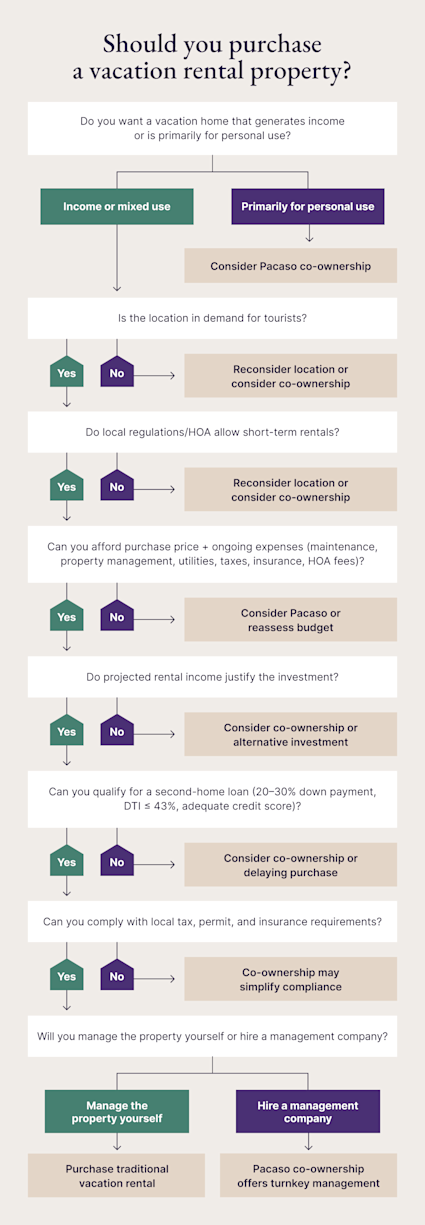

Location, location, location — that’s important not just when purchasing a primary home but when searching for a vacation rental, too. To hone in on the right location, research tourism demand. Consider whether the area is a popular vacation spot for visitors and how consistent the travel season is. Check for local attractions to understand what the area has to offer, whether that’s beaches, golf courses or vibrant cityscapes. And don’t forget to look at accessibility, such as proximity to airports. You should also understand the short-term rental regulations and HOA rules that may apply. Some cities limit how many days a home can be rented, while others might require expensive permits. Some HOAs may not allow short-term rentals at all or have a cap on how many units can be rented at a time. Finally, get clear about how often you hope to use the space yourself. Think about whether you hope to visit frequently or if you’re more likely to keep it rented out for passive income. This is an important consideration — not just logistically but also because of tax and financial implications.

2. Run the numbers

Prior to buying a vacation property, crunch the numbers to understand whether you can afford a second home. Of course, you need to think about the cost to purchase a rental, but don’t stop there. A second home calculator can help you determine what you can afford. Then, research rentals in the area to get a feel for average prices, occupancy and costs.Vacation rental income

When it comes to what you’ll bring in, consider the possible return on your investment, including:- Possible occupancy rates

- Daily rental prices

- Higher pricing for peak seasons

Vacation rental expenses

Next, think about the potential expenses of owning a vacation rental. These may include:- Maintenance: Being a homeowner means being prepared for repairs and upgrades as needed.

- Property management: If you don’t want to take on the work of running the rental, you can hire a property manager, but these companies typically charge a percentage of your monthly rental income.

- Cleaning: If you can’t (or don’t want to) handle cleaning on your own, you’ll need to pay for professional cleaners after each guest.

- Utilities: Keeping the lights, water and heating/cooling running requires regular payments.

- HOA fees: Depending on where you purchase a vacation home, you may be required to join an HOA with additional monthly costs.

- Insurance: Vacation rentals are not typically covered in standard homeowners insurance policies, so you may need to find additional coverage.

- Taxes: Just like with your primary home, your monthly payment will include property taxes, the amount of which varies by location.

- Interest: Interest rates for a second home are often higher than for a primary home.

3. Secure financing

Financing a vacation rental can be more complicated than purchasing a primary home. Second home mortgages differ from those used for primary homes, and costs can be higher as well. Look into the various options, including second-home loans and investment property loans, and see what best fits your needs. There are a few unique impacts a second home can have on financing. Prepare for a higher down payment, at least 20%–30%, and stricter lending terms. Not only that, but credit score requirements can be higher as well. You’ve also got to consider the effect on your debt-to-income (DTI) ratio, which includes any current debt plus the debt you’d take on with a vacation home. Make sure you factor that in and don’t exceed the common 43% DTI ratio limit. Some lenders might require you to demonstrate rental income potential, so gather comps to make your case. And just like with any home purchase, plan for additional costs, including:- Furnishing the property

- Insurance coverage

- Property management

- Taxes

4. Understand legal and tax requirements

Look into the unique legal and tax requirements of the local area. Some locales require operating permits or occupancy taxes, and in most cases, you’ll be on the hook for different tax rates for an investment property than for a primary residence. It’s crucial to have proper insurance coverage, too, so ensure your policy covers short-term rentals. Many homeowners insurance policies don’t include this as a matter of course, so do your due diligence. And finally, if your property is part of an HOA, you should understand the bylaws and rules to make sure you’re permitted to rent out the unit. If your prospective vacation rental is outside the country, be sure to look into laws and taxes for international buyers before making a commitment.5. Manage the property

After you’ve selected a property and made the purchase, decide how you’ll manage it. You might choose to manage it on your own, which can be time-consuming: you’ll be responsible for all communication with guests, booking, marketing and maintenance. Another option is to hire a property management company, which can be more expensive but simplifies the process and takes the work off your hands. Keep track of your income, expenses and taxes to ensure you’re compliant with regulations. You may also want to consider additional vacation rental insurance that helps protect against liability issues or damage from guests.

Buying a vacation rental vs. co-owning with Pacaso

Buying a vacation rental can be rewarding, but it also brings risk, including financial and logistical challenges as well as quite a bit of work to keep everything running. This can quickly turn your relaxing haven into a demanding second job. Pacaso offers a way to own a vacation home without the stress and for a lower cost.With Pacaso’s co-ownership model, you pay a fraction of the cost and share expenses with fellow co-owners, giving you a beautifully designed and furnished home with dedicated support: Pacaso provides a team to help before, during and after your stay. You’re able to book a stay simply via the Pacaso owner app, and many co-owners visit their vacation homes six to seven times a year. But if you someday decide to move on, you can sell your shares. Historically, shares have sold for an average 10% gain, so you can come out ahead.| Feature | Traditional vacation rental ownership | Pacaso co-ownership |

| Upfront cost | Full purchase price plus closing costs | Fractional ownership starting at ⅛ share |

| Ongoing expenses | Sole responsibility for taxes, utilities, insurance and maintenance; may also pay for property management support | Costs shared among co-owners |

| Management and maintenance | Self-managed or handled by property management company | Handled by Pacaso |

| Personal enjoyment | Limited by rental bookings | Designed for owner use |

| Risk | All risk assumed by owner | Risks shared among co-owners |

| Resale | Subject to market conditions; can take time and be costly | Simple with Pacaso’s resale platform |

| Complexity | High, including permitting, guest management and upkeep | Low, with a turnkey ownership experience |

Simplify your vacation home dreams with Pacaso

Buying a vacation rental sounds appealing, but the downsides might make you think twice. If you’re still dreaming of a way to buy vacation rental property, consider Pacaso. Pacaso offers turnkey luxury at an affordable, shared cost — we even offer financing of up to 70% with trusted lenders. Plus, we provide dedicated property managers to make your vacation home a true vacation, with virtually none of the work of traditional rental investments. Ready to find your dream vacation home? Check out our luxury homes today.Buying a vacation rental FAQ

01: Is it a good investment to buy a vacation rental property?

02: What’s a good alternative to buying a vacation rental?

A great alternative to buying a short term rental investment is engaging in a co-ownership model like Pacaso. This lets you reap the benefits of owning a second home, including equity, recreation and luxury, without the additional work required by traditional ownership.

03: What should you look for when buying a vacation rental property?

Pay attention to location, regulations, requirements and financials. Look for an area with year-round demand and accessibility, then research local regulations and start estimating your cost and income projections (be conservative). Before committing to a purchase or starting a vacation rental business, consider whether you’d rather spend your time running a rental — or relaxing or adventuring with a second home from Pacaso.