| Key takeaways |

|---|

| This in-depth guide will teach you everything you need to know about writing a letter of explanation for a mortgage loan, including a free letter of explanation template to help you craft a clear and effective letter of your own. |

Menu

- What is a letter of explanation?

- Why do you need a letter of explanation?

- How to write a letter of explanation step by step

- Tips for a stronger letter of explanation

- Letter of explanation sample

- Letter of explanation template

- Why is a letter of explanation needed for a vacation home mortgage?

- How does Pacaso help with vacation home financing?

| What is a letter of explanation? |

|---|

| A consumer explanation letter, also known as a "letter of explanation," is a document submitted to a lender to address questions or concerns about a borrower’s financial or employment history when applying for a mortgage loan. |

Why do you need a letter of explanation?

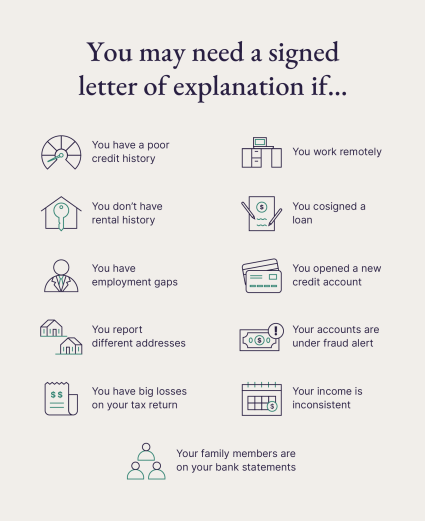

There are several reasons why an underwriter or mortgage lender may request a signed letter of explanation, particularly when it comes to a second home mortgage. Most pertain to gaps in employment, rental history, or on-time payments.

1. You have a poor credit history

Your credit history helps lenders know how you’ve handled debt in the past. The following red flags can potentially indicate poor debt management and may require a letter of explanation:- Late payments

- Bankruptcy

- Foreclosures

2. You don’t have rental history

Ideally, lenders want to see that you have a consistent rental history for the last 12 months. This reassures them that you will be able to handle regular mortgage payments. If you have a gap in your rental history, explain the cause. Caring for a family member or recovering from an accident are possible explanations for a rental hiatus.3. You have employment gaps

Similar to your rental history, lenders prefer to see consistent employment in the year before your loan application. This shows the lender that you have the income to make regular mortgage payments.A lender can be flexible when they know more about the circumstances that led to an employment gap. Being laid off or raising children are possible explanations for the lack of recent work experience.4. You report different addresses

If the address on your driver’s license does not match the address on your loan application or credit report, a lender may ask you to explain the discrepancy.5. Your income is inconsistent

Underwriters will carefully review your income. If it fluctuates often, they may request a letter of explanation. If you are self-employed, your accountant may also have to write a letter of explanation to verify how you generate your income. You might also find it helpful to use a second home mortgage calculator to estimate your potential payments.6. You work remotely

If your remote career is tied to an address in a city or state that is different from where you are buying a home, especially if that home is intended to function as a second home office, a lender may request that your company provide a letter of explanation verifying that your job (and income) will not be affected by your move. This situation is becoming increasingly common with the rise of “Zoom towns.”.7. You have substantial losses on your tax return

If you are a self-employed business owner or independent contractor, it’s normal to file losses on your first few tax returns. A lender may request a letter of explanation to ensure that these losses will not be recurring or affect your ability to make regular mortgage payments.8. You cosigned a loan

In the event that you cosigned a loan, a lender will want a letter of explanation stipulating that you are not the one making the payments. This can apply to student loans, auto loans and mortgages, even for a second home or investment property.9. You opened a new credit account

If you open a new credit account while applying for a mortgage loan, a lender may suspect that the debt could affect your ability to repay your loan. Remember that the underwriter will also review your finances during closing, so hold off on opening new lines of credit until the sale is complete, if possible.10. Your family members are on your bank statements

If multiple people appear on your bank statements, like parents or children, you will need to write a letter explaining that you’re in control of the funds being used to pay for your new home. Anyone who helps you with the down payment of the home will also be responsible for writing a gift letter of explanation.11. Your accounts are under fraud alert

A lender will want to know that you’re aware of any suspicious activity on your credit report. If your accounts are under fraud alert or your credit is frozen, prepare a letter of explanation that outlines how you will regain control of your finances.How to write a letter of explanation step by step

Before you write a letter of explanation for a mortgage, you’ll need some information first. Some of this you’ll have readily available (like your name), but you might have to gather or research other details, such as specific dates or documentation related to the situation you're explaining.

- Your full legal name

- Your spouse's full legal name (if applying together)

- Your current mailing address

- The address of the lender

- Your phone number

- Marriage license, if applicable

- Bills of sale (for large assets like a car)

- Title transfers

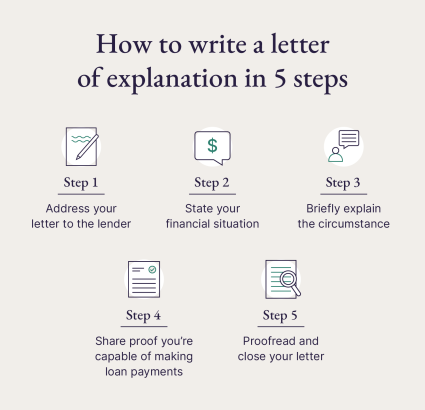

Here is how to write a letter of explanation:

- Header & date: Put the date and the lender’s name/address at the top.

- Salutation: Address the correct person or department (e.g., “Dear Underwriting Team” or the loan officer’s name).

- State the purpose up front: One short sentence that says why you’re writing the letter of explanation (e.g., “I am writing to explain a late payment on my credit card account from March 2024”).

- Be clear and factual: Briefly describe what happened, with specific dates and facts. Stick to the essentials; keep it concise.

- Show resolution & evidence: Explain what you’ve done to fix the issue and attach supporting documents (payments, letters, bank statements, etc.).

- Close politely: Restate your willingness to provide more information, sign with your full name, current address, and contact info.

Tips for a stronger letter of explanation

Writing a letter of explanation can get you one step closer to financing the second home of your dreams. For best results, remember these tips.- Keep it short: one page or less, ideally 3–5 short paragraphs.

- Use plain, professional language: avoid jargon or emotional language.

- Take responsibility where appropriate: don’t deflect blame.

- Attach proof: label and reference any supporting documents in the letter.

- Be specific: include dates, amounts, account numbers (last 4 digits), and relevant details.

- Maintain a calm, respectful tone: professionalism builds trust.

- Proofread: check grammar, spelling, and formatting; consider a second pair of eyes.

- Address it correctly: sending to the wrong department can delay processing.

- Keep a copy: save the letter and all attachments for your records.

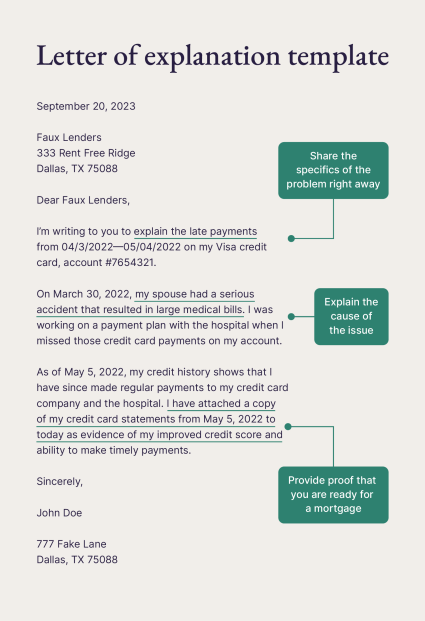

Letter of explanation sample

Keeping your explanation letter short and sweet is key. If you're struggling to write a concise letter of explanation, here is a letter of explanation sample to use as a guide and point of reference

Letter of explanation template

To make the process even easier, download this free letter of explanation template. Just fill in your information and personalize as needed.

Why is a letter of explanation needed for a vacation home mortgage?

Lenders may request a letter of explanation to better understand certain aspects of your financial or credit history before approving a vacation home mortgage. This helps them assess your ability to manage the new loan responsibly. Common situations include:- Carrying multiple mortgages or loans and demonstrating the ability to manage payments.

- Recent late payments, collections, or charge-offs on credit accounts.

- Gaps in employment or significant changes in income.

- Large or unusual deposits and withdrawals in bank accounts.

- Multiple recent credit inquiries or new lines of credit.

- A high debt-to-income ratio relative to your income.

- Any other circumstances that could raise questions about your ability to repay the loan.

How does Pacaso help with vacation home financing?

Vacation home financing comes with its own set of requirements and considerations. With a fully managed co-ownership model like Pacaso, you leave behind many of the costs of buying a second home like maintenance, upkeep and furnishings. Plus, Pacaso offers flexible financing options. Refer back to our free template if you need help preparing an explanation letter for your next real estate purchase. And don’t forget to view our portfolio of international homes to inspire your next dream property.Letter of explanation FAQ

01: What is a letter of explanation for a mortgage lender?

A letter of explanation clarifies negative marks on your credit report and assures an underwriter or lender that you are capable of paying off a mortgage.

02: What is a letter of credit application?

A credit application is a formal request from an individual or business to a lender for a loan or line of credit. It includes personal and financial details that help the lender decide if the applicant can repay the money.

03: How can I explain late payments or a mortgage loan application?

If you need to explain late payments on a mortgage application, be honest and specific about why they happened, like a job loss or medical issue. Crucially, explain how you've fixed the problem and what you're doing to avoid it in the future. Including documents to support your explanation and show you're financially stable now can help.

04: How long should a letter of explanation be?

A letter of explanation should be as brief as possible, consisting of three paragraphs that span no more than three-quarters of a page.

05: What is a letter of explanation address verification?

You’ll need to send a letter of explanation address verification to your lender if your current physical address does not match the address on your mortgage application or credit report.

06: What should a letter of explanation include?

Include the reason you’re writing, specific details like dates, amounts, or accounts, and a brief explanation of the circumstances. Highlight any steps you’ve taken to resolve the issue and provide evidence when relevant.

07: How do you write a letter of explanation?

Begin by addressing the letter to the correct lender or department. State the purpose upfront, then explain the situation clearly and concisely. Attach any relevant supporting documents, keep your tone professional, proofread carefully, and close with your full name and contact information.

08: Why is a letter of explanation needed for a vacation home mortgage?

Lenders use a letter of explanation to understand any unusual or concerning parts of your financial or credit history. It gives context for things like late payments, gaps in employment, or carrying multiple mortgages so they can feel confident you can handle the loan.