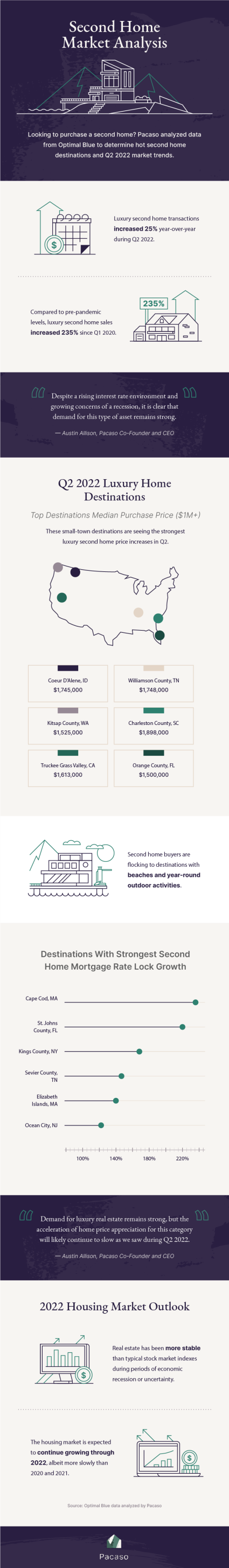

Pacaso Second Home Market Report: Transactions have slowed, prices have soared

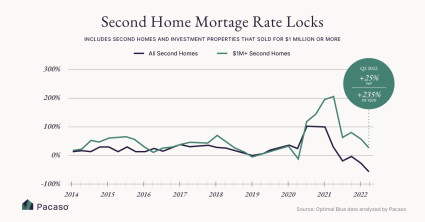

Second home market trends: Key takeaways Second home market cooled in summer, but still relatively hot Across the nation, second home rate locks — a proxy for second home transactions — increased throughout the pandemic, peaking in summer 2020 and again in spring 2021, but falling 26.6% year over year this past summer. Despite this recent cooling of the pandemic-fueled second home surge, overall market share of second homes is still up from pre-pandemic levels. From 2017 through 2019, second home transactions averaged a 3.8% quarterly market share of all rate locks. As of summer 2021, that percentage was up from pre-pandemic levels, with second homes comprising a 4.3% market share. “A year ago as Pacaso was preparing to launch, we wanted to better understand the second home market, and quickly realized there was a massive gap in local, timely second home data,” said Pacaso CEO Austin Allison. “It’s estimated that there are nearly 10 million second homes in the U.S., and with pandemic-driven shifts that have allowed people greater flexibility around where they live and work, we expect to see this number continue to grow. The second home housing market represents a significant subset of the market that is critical to watch in order to fully understand the U.S. housing market.” The Pacaso Second Home Market Report, which analyzes timely and localized data for the top 50 second home markets, is a composite including property use and mortgage rate lock data. It includes counties with a percentage of seasonal homes and median home values at or above the top 20th percentile. Mortgage rate lock data is a leading indicator of consumer second home buying activity. Transaction volumes decreasing, but home prices up across top 50 markets Most of the top vacation destinations are seeing second home mortgage rate locks decline, but prices remain highly elevated and continue to rise. All but one county tracked in Pacaso’s report saw double-digit price growth in second home purchase prices this past summer. Kauai, Hawaii, saw the highest growth, with a median purchase price of $1.25 million, up 83.3% compared to a year ago. The island of Kauai has seen Wasatch County, Utah, and Gunnison County, Colorado, also saw sharp increases in second home purchase prices, up 53.9% and 53.2% respectively year over year. Prior to this spike, Wasatch County historically had a lower median second home price than neighboring Summit County, Utah, which is home to popular resort town Park City. Meanwhile, Gunnison County, located in the Colorado Rockies and home to ski resort Crested Butte, still has a lower median second home price than neighboring Summit County, Colorado, which is home to a number of famous ski destinations like Breckenridge, Keystone, and Copper Mountain. Of the top 50 second home destinations analyzed, 46 saw a year-over-year decline in transaction activity in the summer months. However, trends in four second home markets stood out as exceptions: Demand is creating a new wave of second home markets “It’s clear that there’s been a sea change not only in where people live and work, but also where they choose to get away from it all. The market looks completely different than it did two or three years ago,” said Pacaso CEO Austin Allison. “It used to be that major metros were the primary hotbeds of real estate activity, and now we are seeing double-digit price growth across the entire U.S., and intense interest in second homes in places like Boise, Idaho, and Eagle County up in the Colorado Rockies. This widespread demand is creating a new wave of second home markets with more moderate median home prices but the same types of amenities and outdoor recreation options typical of their more famous counterparts.” At the other extreme, El Dorado County, California saw the biggest decline in second home mortgage rate lock volumes, down by 62.5%, which was almost certainly related to this summer’s wildfires in Lake Tahoe. Cass County, Minnesota (-60.7%), Chelan County, Washington, and Beaufort County, South Carolina were just behind, both down 59% year over year. Most of these markets posted extreme growth the year before, which was not sustained. Methodology Pacaso identified the nation’s top second home markets by compiling census data on counties with a percentage of seasonal homes and median home values at or above the top 20th percentile and by excluding those below the bottom 10th percentile of counties with the fewest households. Counties without at least 20 second home transactions in the period were also excluded from the analysis. Pacaso then analyzed real estate activity in the top second home markets by observing mortgage rate lock data, a leading indicator of second home buying activity. When applying for a mortgage rate lock, a home buyer must specify whether they are securing a mortgage rate for a primary home, secondary home or an investment property. Approximately 80% of mortgage rate locks result in home purchases. Mortgage rate lock data was provided by real estate analytics firm Optimal Blue and includes a sizable share of the market that is taken to be representative of the whole. Second home rate lock transactions and median purchase price data were sourced at the county level with the months June through August 2021 comprising the “summer” period in this analysis.

Read